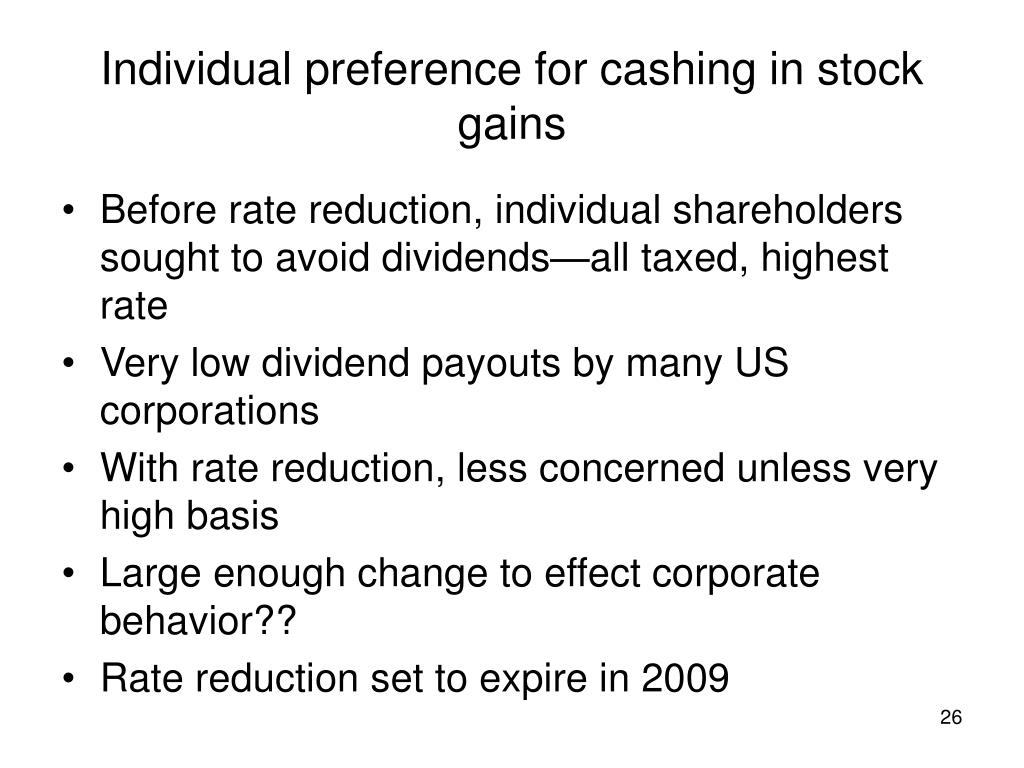

Cashing in stock options taxes

Your source for data-driven advice on investing and personal finance. See how Wealthfront can help you reach your financial goals. This is not just a Hollywood story.

In my past role as a tax accountant in Silicon Valley, I saw many executives and employees get greedy, too. A surprisingly large number of people fall into this trap.

Some of them are just ill-informed. Others, I believe, are overcome by their greed: It causes them to forget that stock prices can go down as well as up, or keeps them from embracing a rational plan to pay the taxes. The employer decides how much to withhold, based on guidelines from the IRS and the states.

Unless you sell stock at the time of exercise to cover your withholding, you will have to write a check to your employer for the taxes withheld.

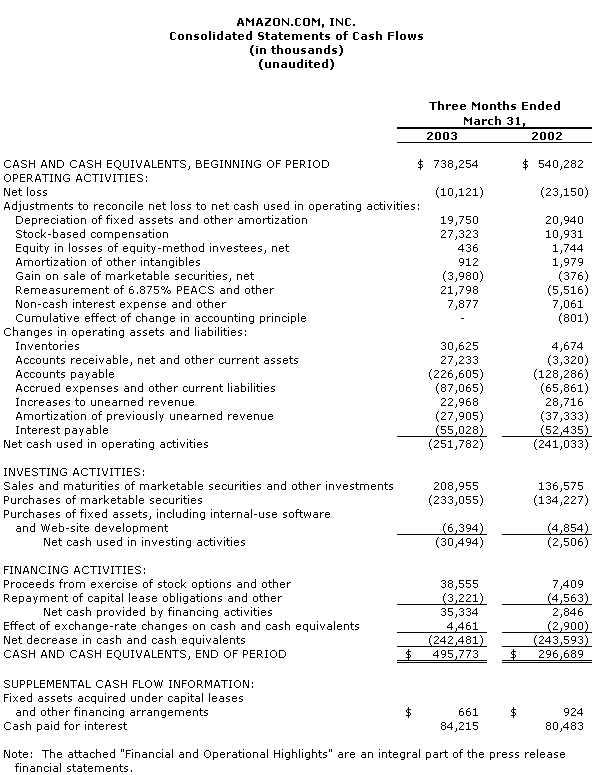

If you have incentive stock options ISOs , your employer will not withhold taxes. Whether you have NQOs or ISOs, you will need to set aside money held in another account, like a savings or money market account, to pay taxes. Following are two scenarios that show what can happen if you get greedy and exercise as many options either non-quals or ISOs as you can without a plan.

You might find yourself in a financial quagmire, stuck owing more in taxes than you have cash on hand to pay. The loss deduction may be subject to annual limits, so your tax savings may not be realized for many years. Also note that you will have a different basis in your stock for regular tax and AMT purposes, as well as an AMT credit carryover, which should be taken into consideration. Do these scenarios sound unlikely? I have seen versions of them happen dozens of times, often enough that I tell this cautionary tale whenever I can.

This is commonly referred to as a cashless exercise. On exercise, you immediately sell enough stock to pay both the exercise price and your anticipated tax liability. But remember that you should still set aside some money for the incremental tax due.

If you hold stock from previously exercised options, that gives you the opportunity to sell the stock as you exercise additional options.

This choice can be particularly beneficial if stock has been held for over one year and the associated gain qualifies for favorable long-term capital gain tax treatment.

Be just as rational when it comes to your options as you are when you are planning your investment portfolio. That may mean parting with some of the potential upside to avoid a catastrophic downside. This article is not intended as tax advice, and Wealthfront does not represent in any manner that the outcomes described herein will result in any particular tax consequence. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances.

Wealthfront assumes no responsibility for the tax consequences to any investor of any transaction. Bob Guenley was a tax accountant to Silicon Valley executives from the s through the s, and currently works for a leading venture capital firm.

Many young executives worry about triggering taxes by exercising options. But, as Kent Williams, founding….

Get The Most Out Of Employee Stock Options

Sixteen states and the District of Columbia now allow same-sex couples to legally marry. Vanguard versus Wealthfront — how do the two compare? In this post, we compare the two services and explain the relative advantages of Wealthfront. Path helps you prepare for your financial future, every step of the way. Please read important legal disclosures about this blog.

This blog is powered by Wealthfront. The information contained in this blog is provided for general informational purposes, and should not be construed as investment advice. These contributors may include Wealthfront employees, other financial advisors, third-party authors who are paid a fee by Wealthfront, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Wealthfront or any of its officers, directors, or employees.

Wealthfront Knowledge Center Your source for data-driven advice on investing and personal finance. Disclosure This article is not intended as tax advice, and Wealthfront does not represent in any manner that the outcomes described herein will result in any particular tax consequence. Tags career advice , career planning , employee compensation , mistakes , stock options , taxes. About the author Bob Guenley was a tax accountant to Silicon Valley executives from the s through the s, and currently works for a leading venture capital firm.

View all posts by Bob Guenley Questions? Explore our Help Center or email knowledgecenter wealthfront.

Avatars by Sterling Adventures. Why Employee Stock Options are More Valuable than Exchange-Traded Stock Options. A few years ago, as I was delivering a job offer to a candidate at…. When Should You Exercise Your Stock Options?

Understanding Your Options- Tax Implications of Stock Options

Stock options have value precisely because they are an option. The fact that you have…. Tax Issues for Married Same-Sex Households. Read the blog post. Want all new articles delivered straight to you inbox? Join the mailing list! Careers Blog Help Center Legal Contact Back to top.