Calculate diluted earnings per share stock options

Calculating Diluted Earnings per Share

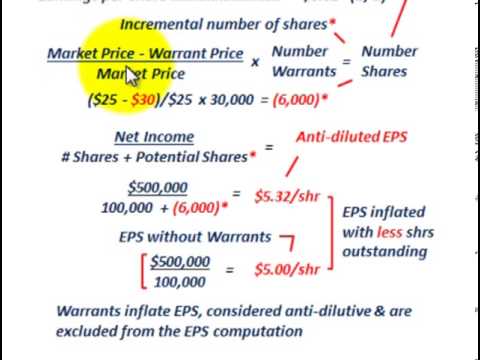

The treasury stock method is an approach companies use to compute the amount of new shares that can be potentially created by unexercised in-the-money warrants and options. Additional shares obtained from the treasury stock method go into the calculation of the diluted earnings per share EPS. This method assumes that the proceeds that a company receives from an in-the-money option exercise are used to repurchase common shares in the market.

To comply with generally accepted accounting principles GAAP , the treasury stock method must be used by a company when computing its diluted EPS. The method assumes that options and warrants are exercised at the beginning of the reporting period, and a company uses exercise proceeds to purchase common shares at the average market price during the period.

Calculating Basic and Fully Diluted EPS in a Complex Capital Structure

The amount of additional shares that must be added back to the basic share count are calculated as the difference between the assumed share count from the options and warrants exercise and the share count that could have been purchased on the open market. However, this number ignores the fact that 10, of shares can be immediately issued as a result of exercise of in-the-money options and warrants.

The additional 5, shares, which are the difference between 10, assumed issued shares and 5, assumed repurchased shares, represent the net new shares issued as a result of the potential options and warrants exercise.

The diluted share count is ,, which is the sum of , basic shares and 5, additional shares. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

Multiple Choice Quiz

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Treasury Stock Method Share. What is the 'Treasury Stock Method' The treasury stock method is an approach companies use to compute the amount of new shares that can be potentially created by unexercised in-the-money warrants and options. Warrant Premium Put Warrant Exercise Price Early Exercise Warrant Call Warrant Basic Earnings Per Share Warrant Coverage American Option.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.