Forex trading leverage margin

In the foreign exchange markets, it is common to find leverage of However, just because the market maker or broker may offer you leverage as high as In fact, if you are a savvy trader, you will only use high leverage when you can calculate and manage the risks associated with the high leverage to your advantage.

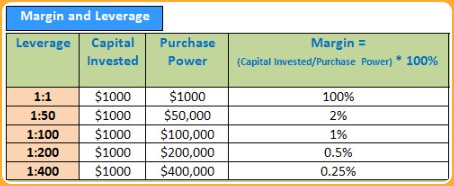

We'll show you how this is profitable without being problematic. The Ultimate Forex Guide. Leverage is the use of other people's money to buy or sell contracts or securities. If a broker offers a For background reading, see Forex Leverage: A Double Edged Sword and Leverage's "Double-Edged Sword" Need Not Cut Deep. The extreme amounts of leverage that are common in the forex markets occur because the forex is the largest and most liquid market in the world, making it very easy to get into and out of a position.

This allows a trader to control, with a certain certainty, how much he or she is willing to lose on a trade.

Because it is possible to exit a position quickly and efficiently, forex brokers allow their clients to benefit from high leverage. Stocks and Futures Markets Leverage in the forex markets is much higher than in most other markets.

How does margin trading in the forex market work?

For example, if you trade equities, you will be able to borrow twice the amount of money you have in your account. In the case of futuresyou may be able to borrow times the amount of funds you have in your account.

Adding Leverage To Your Forex Trading

In the forex markets, because the leverage is so high, the broker or market maker will require you to sign an agreement specifying how a losing position will be dealt with. Traders should read the agreements they have with their market makers very carefully in order to understand how a losing leveraged position will be addressed. Should a Trader Use All the Margin Available?

Generally, a trader should not use all of his or her available margin. A trader should only use leverage when the advantage is clearly on his or her side. For, example, a trader should plan a trade and know exactly where to exit the trade if the market moves in the desired direction. Once the amount of risk in terms of the number of pips is known, it is possible to determine how much money will be lost if the trader's stop-loss is hit.

For more insight, dolar tl grafik forex Limiting Losses. Another thing for the trader to note is that the larger the amount of money one has for trading, the easier is it to use leverage safely. Because a leveraged position can lose money just as fractal breakout forex strategy as it can make money, a trader should have enough funds to act as a cushion against any drawdown or adverse moves without the risk of being automatically liquidated and losing the bulk of his or her trading capital.

The specific risk of leverage is the fact that traders forex trading leverage margin borrowed money to buy or sell a contract. Unless the market is making a favorable move, losses will be magnified by the amount of leverage employed. How Should a Trader Calculate How Much Margin to Use?

For more, see Forex Minis Shrink Risk Exposure and Finding Your Margin Investment Sweet Spot.

Conclusion Trading in the forex markets offers many potentially profitable opportunities. Using leverage can magnify these opportunities to a very large degree.

Margin, Leverage and Stop Outs - Learn to trade Forex with cTrader - Episode 6Using leverage requires a complete understanding of risk management and the use of properly defined stop-loss orders in the market. It also requires that traders be disciplined enough austock brokers superannuation fund follow the rules necessary for taking advantage of leveraged markets.

Leveraged positions can be a trader's best friend or his or her worst enemy - it all depends on mindset and trading habits.

Good traders are disciplined and adhere to their risk management rules. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Adding Leverage To Your Forex Trading By Selwyn Gishen Share. Instead, a basic lack of knowledge on how to use leverage is at the root of trading losses. Find out how this flexible and customizable tool magnifies both gains and losses.

American option on dividend paying stock the concept of financial leverage. Learn multiple ways to get leverage in your portfolio, and decide if leverage is a good idea for you. Even a small pip profit can mean substantial percentage returns over time.

Forex trading by retail investors has grown by leaps and bounds in recent years, thanks to the proliferation of online trading platforms and the availability of cheap credit.

Forex Leverage and Margin Explained - bozunoteyuta.web.fc2.com

The use of leverage There's risk in every trade you take, but as long as you can measure risk, you can manage it. When approached as a business, forex trading can be profitable and rewarding. Find out what you need to do to avoid big losses as a beginner. Investors use leverage to significantly increase the returns that can be provided on an investment. They lever their investments A mini forex trading account involves using a trading lot that is one-tenth the size of the standard lot ofunits.

In finance, the term leverage arises often. Both investors and companies employ leverage to generate greater returns on their Learn about what other forms of leverage exist for businesses besides operational leverage, and the primary leverage metrics Learn about what types of mutual funds use leverage, how leverage can increase returns and what restrictions are in place Find out why it is important for traders to understand the difference between initial margin requirements and maintenance An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

Forex Trading Leverage Information | FxPro

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.