Pricing american options with discrete dividends by binomial trees

European options are commonly traded in the commodity markets. They have closed-form pricing equations, derived from the traditional Black-Scholes analysis. The equations are easily implemented in spreadsheets or programming languages. Most exchange-traded options are, however, American options. American options can be exercised at or before expiry; this greater flexibility for the option holder results in greater risk for the option writer.

This means American options are more expensive than European options.

Institutional Investor Journals: The Journal of Derivatives - 21(1)

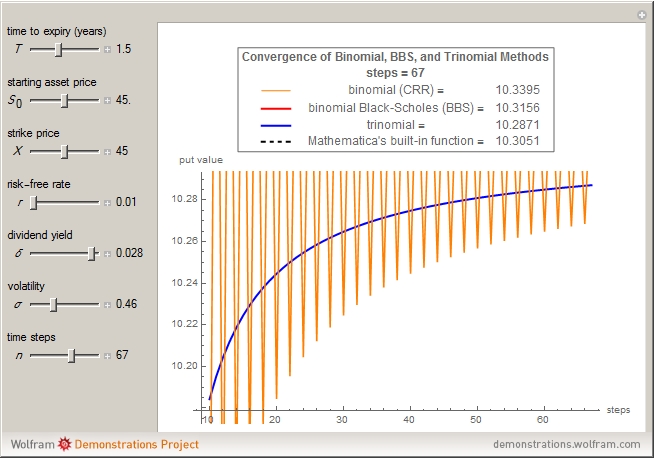

American options do not have closed-form pricing equations. Accordingly, many numerical techniques and approximations for pricing American options have been developed.

Fast Trees for Options with Discrete Dividends by Nelson Areal, Artur Rodrigues :: SSRN

Several of the most popular methods are summarized below. This method separates the value of American options into two parts. The first is the value of an European option, and the second is the value of early exercise. This approximation model can be used for options with a continuous dividend, a constant dividend yield, and discrete dividends.

The method is fast and computationally efficient. If the value of the underlying asset is greater than or equal to a trigger price, the option should be exercised. However, if the risk-free rate is less than or equal to the cost of carry, the the value of the option is calculated by the Black-Scholes Model. This method, first published inis more accurate than the quadratic approximation for options with small or large maturity times.

This makes pricing american options with discrete dividends by binomial trees particularly suitable for pricing American options, which can be exercised at any time before expiry. These Excel pricing american options with discrete dividends by binomial trees implement the pricing approximations described above.

Excel Spreadsheet for Pricing American Options with a Binomial Tree. Excel Spreadsheet for Pricing American Options with a Trinomial Tree. Try downloading the American Option approximation spreadsheet again.

Option Pricing Models (Black-Scholes & Binomial) | Hoadley

One of the inputs is crude oil option chain volatility. How many bars do you recommend for the stock volatility calculation? Many thanks for sharing the VBA code on this. Do you perhaps have code for calculating the the Greeks off these approximations? Your email address will not be published. Skip to content Privacy Policy About Me Questions About The Spreadsheets?

Premium Excel Tools Kudos Baby. Business Analysis Portfolio Analysis Option Pricing Technical Trading Buy Spreadsheets Commentary. Home Option Pricing American Options — Pricing Methods and Spreadsheets American Options — Pricing Methods and Spreadsheets 4.

Detailed steps for constructing a binomial tree is given herewhile trinomial trees are described here. Additionally, constant volatility is assumed.

August 22, at 5: Thank you so much, Tyler Ray. August 24, at 7: Hi Tyler Try downloading the American Option approximation spreadsheet again. October 9, at 8: November 16, at 9: Leave a Reply Cancel reply Your email address will not be published. Please leave these two fields as-is: To be able to proceed, you need to solve the following simple math so we know that you are a human: Like the Free Spreadsheets? This site takes time to develop.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Twitter Tweets by investexcel.