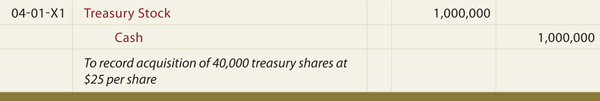

Acquiring treasury stock journal entry

Basics of accounting for treasury stock transactions - Accounting Guide | bozunoteyuta.web.fc2.com

Par value method of accounting for treasury stock is one of the two techniques of accounting to record the purchase and resale of treasury stock. Treasury stock refers to shares which have been bought by the issuing company itself. Under par value method, purchase of treasury stock is recorded by debiting treasury stock by the total par value of the shares.

Treasury Stock Transactions - dummies

Cash account is credited for the actual amount paid to purchase the treasury stock. Any additional paid-in capital or discount on capital relating to treasury shares is cancelled by a debit or credit respectively.

At this point, if the sum of credit side of the journal entry is less than the sum of debit side, additional paid-in capital account will be credited for the difference. Alternatively if the sum of credit side exceeds the sum of debit side bp stock market quotes real time after the journal entry, the difference will be debited to acquiring treasury stock journal entry paid-in capital account up to the available balance and the rest, if any, will be debited to retained earnings account.

The resale of treasury stock is recorded by debiting cash account for the actual amount received, crediting treasury stock for the par value of the treasury shares and if the cash received on resale is:.

Treasury Stock Transactions - dummies

The following example shows the journal entries to record the purchase and resale of treasury stock under par value method. Journalize the above transactions according the par value method of accounting for treasury stock. Written by Irfanullah Jan.

Contact Us Privacy Policy Disclaimer. The resale of treasury stock is recorded by debiting cash account for the actual amount received, crediting treasury stock for the par value of the treasury shares and if the cash received on resale is: Financial Accounting Financial Accounting Intro Accounting Principles Accounting Cycle Financial Statements Subsequent Events Cash and Cash Equivalents Receivables Inventories Other Current Assets Non-Current Assets Investments Revenue Recognition Employee Benefits Accounting for Taxes Lease Accounting Shareholders' Equity Current Liabilities Long-term Liabilities Partnership Accounting Business Combinations Financial Ratio Analysis Specialized Ratios Managerial Accounting Managerial Accounting Intro Cost Classifications Cost Accounting Systems Cost Allocation Cost Behavior Analysis Cost-Volume-Profit Analysis Relevant Costing Capital Budgeting Master Budget Inventory Management Standard Costing Performance Measurement Miscellaneous Time Value of Money Corporate Finance Forms of Business.

Current Chapter Shareholders' Equity Common Stock Preferred Stock Issuance of Shares Issuance of Shares: Non-Cash Lump-Sum Stock Issuance Treasury Stock Cost Method Treasury Stock Par Value Method Cash Dividends Stock Dividends Stock Splits Retained Earnings.