Spread trade future investopedia

By John Summa , CTA, PhD, Founder of OptionsNerd.

With a little bit of effort, however, traders can learn how to take advantage of the flexibility and full power of options as a trading vehicle. With this in mind, we've put together the following options spread tutorial, which we hope will shorten the learning curve.

The majority of options traded on U. On the other hand, what the industry terms "complex trades" comprise just a small share of the total volume of trades.

It is in this category that we find the "complex" trade known as an option spread. Using an option spread involves combining two different option strikes as part of a limited risk strategy.

While the basic idea is simple, the implications of certain spread constructions can get a bit more complicated. This tutorial is designed to help you better understand option spreads, their risk profiles and conditions for best use.

While the general concept of a spread is rather simple, the devil, as they say, is always in the details. This tutorial will teach you what option spreads are and when they should be used.

Spread

You'll also learn how to assess the potential risk measured in the form of the " Greeks " - Delta , Theta , Vega involved with the different types of spreads used, depending on whether you are bearish, bullish or neutral. So, before you jump into a trade you think you have figured out, read on to learn how a spread might better fit the situation and your market outlook.

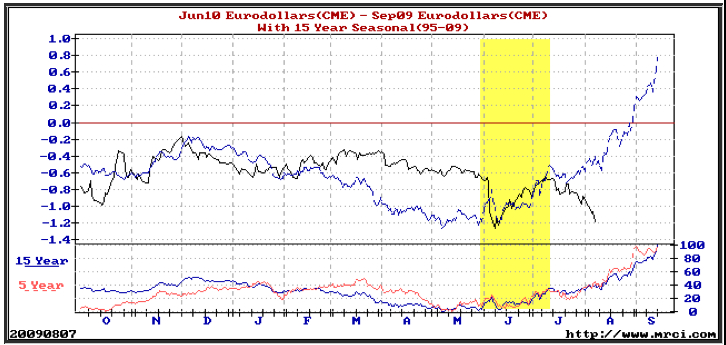

Futures Spread

If you need a refresher course on the basics of options and option terminology before you delve any deeper, we suggest you check out our Options Basics tutorial. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Calendar Spread

Option Spread Strategies By John Summa Share. Selling And Buying To Form A Spread Option Spreads: Vertical Spreads Option Spreads: Debit Spreads Structure Option Spreads: Credit Spreads Structure Option Spreads: Horizontal Spreads Option Spreads: Diagonal Spreads Option Spreads: Tips And Things To Consider Options Spreads: There are ways to control risks, reduce losses and increase the likelihood of success in your portfolio.

Find out how spreads can help. Writing bull put credit spreads are not only limited in risk, but can profit from a wider range of market directions. Futures investors flock to spreads because they hold true to fundamental market factors.

This trading strategy is an excellent limited-risk strategy that can be used with equity as well as commodity and futures options. You may participate in both a b and a k plan.

What Is Spread Betting? | Investopedia

However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Purchase life insurance in your qualified retirement plan using pre-tax dollars.

Be aware of other ways that life insurance Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.