Black scholes put option continuous dividend yield

This page explains the Black-Scholes formulas for d1, d2, call option price, put option price, and formulas for the most common option Greeks delta, gamma, theta, vega, and rho. In many resources you can find different symbols for some of these parameters.

For example, strike price is often denoted K here I use X , underlying price is often denoted S without the zero , and time to expiration is often denoted T — t difference between expiration and now. Dividend yield was only added by Merton in Theory of Rational Option Pricing, Below you can find formulas for the most commonly used option Greeks.

Some of the Greeks gamma and vega are the same for calls and puts. Other Greeks delta, theta, and rho are different.

The difference between the formulas for calls and puts are often very small — usually a minus sign here and there. It is very easy to make a mistake. If you want to use the Black-Scholes formulas in Excel and create an option pricing spreadsheet, see detailed guide here:.

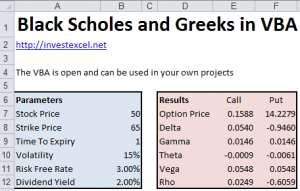

Black-Scholes and Greeks in VBA

Black-Scholes Excel Formulas and How to Create a Simple Option Pricing Spreadsheet. Option Greeks Excel Formulas.

Top of this page Home Tutorials Calculators About Contact. The Agreement also includes Privacy Policy and Cookie Policy. If you don't agree with any part of this Agreement, please leave the website now.

Black–Scholes model - Wikipedia

All information is for educational purposes only and may be inaccurate, incomplete, outdated or plain wrong. Macroption is not liable for any damages resulting from using the content.

Binomial options pricing model - Wikipedia

No financial, investment or trading advice is given at any time. Black-Scholes Formula d1, d2, Call Price, Put Price, Greeks This page explains the Black-Scholes formulas for d1, d2, call option price, put option price, and formulas for the most common option Greeks delta, gamma, theta, vega, and rho.

Black-Scholes Call and Put Option Price Formulas Call option C and put option P prices are calculated using the following formulas: The formulas for d1 and d2 are: Black-Scholes Formulas for Option Greeks Below you can find formulas for the most commonly used option Greeks.

In several formulas you can see the term: Delta Gamma Theta … where T is the number of days per year calendar or trading days, depending on what you are using. Vega Rho Black-Scholes Formulas in Excel If you want to use the Black-Scholes formulas in Excel and create an option pricing spreadsheet, see detailed guide here: Black-Scholes Excel Formulas and How to Create a Simple Option Pricing Spreadsheet Option Greeks Excel Formulas Or get a ready-made Excel calculator here: