Ichimoku cloud trading strategy

Swing Trading With Ichimoku Clouds (AAL) | Investopedia

The Ichimoku Cloud consists of several components which give it a unique capacity to detect trends, determine whether we are in a trend, the direction and the when the trend reverses. Using the Kumo, there is a great strategy to detect key reversals using the Kumo Break Strategy.

Before we can look at this strategy, we must first look at the components of the Kumo. In this article, we refer them to as Span A and Span B respectively. Span A is created through adding the Tenkan Line to the Kijun Line, then finding their average and plotting it 26 time periods ahead.

Ichimoku Cloud Breakout Trading Strategy – it's not as complicated as it looks - Tradingsim

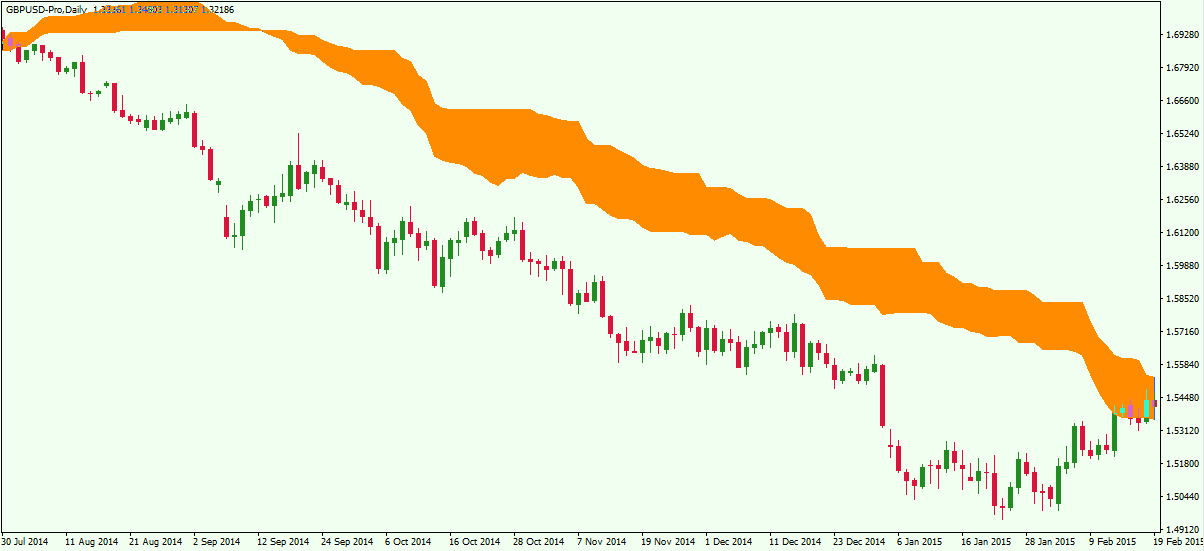

Span B is formed by adding the highest high over the last 52 periods to the corresponding lowest low, then finding their average and plotting the result 26 periods ahead. If the price is below the Kumo, then it is under resistance and it is better to be looking for shorts instead of longs.

The Kumo Break Strategy – Ichimoku Cloud Trading – Ichimoku Strategy

This is because price will stay on one side of the Kumo during a trend. The farther the price action is from it, the stronger the trend and more volatile it is. If the price is clearly above or below it, then when price action breaks the kumo, it can often signal a reversal.

There are several factors which increase the chances of a reversal, such as:. These factors are crucial when analysing to determine whether a Kumo break is signalling a reversal or not. Consider the AUDUSD chart below. The price was below the cloud for a long period on the left side of the chart and sold off massively. After a couple of attempts on the daily chart, the price broke above the cloud.

When it broke below the cloud, the price action moved sideways for a few days. The Kumo Break method is one of the main systems applied by the Ichimoku traders for detecting key reversals.

Ichimoku Cloud Trading Strategy Explained

By using the kumo, we can qualify the current reversal, which provides traders with a unique opportunity to either take profits on current positions, or take a new reversal setup.

It is effective in timing trends, reversals and trading strategic reversals when all the elements are in place. Its ability to measure support and resistance enables the Ichimoku to also provide traders with a unique perspective on the markets.

Nevertheless, there are other major elements required to trade the Kumo Breaks with precision.

We have analyzed Kumo breaks on Forex, Futures, Commodities and Indices over the last 10 years. With our proprietary indicators and analytical programs, we are able to give precise measurements of how far and long a Kumo break should travel which gives you a precision edge when trading them.

To learn more on trading kumo breaks, take a look at the Advanced Ichimoku Course to learn more about our proprietary Ichimoku systems, access to the traders forum, going over live and past setups and more.

Ichimoku Cloud Trading StrategyYou must be logged in to post a comment. Skip to content Ichimoku Strategy.

The Kumo Break Strategy — Ichimoku Cloud Trading The Ichimoku Cloud consists of several components which give it a unique capacity to detect trends, determine whether we are in a trend, the direction and the when the trend reverses. How can we use it for Reversals?

There are several factors which increase the chances of a reversal, such as: Examples Consider the AUDUSD chart below. Conclusion The Kumo Break method is one of the main systems applied by the Ichimoku traders for detecting key reversals.

Leave a Reply Cancel reply You must be logged in to post a comment. Ichimoku Strategy Proudly powered by WordPress.